VAT Exemption

In this section, you will learn how to configure VAT Exemption options in invoices issued by xpressifi. These settings ensure that invoices correctly reflect VAT exemption cases, ensuring compliance with Portuguese tax and customs regulations.

Standard VAT Exemption

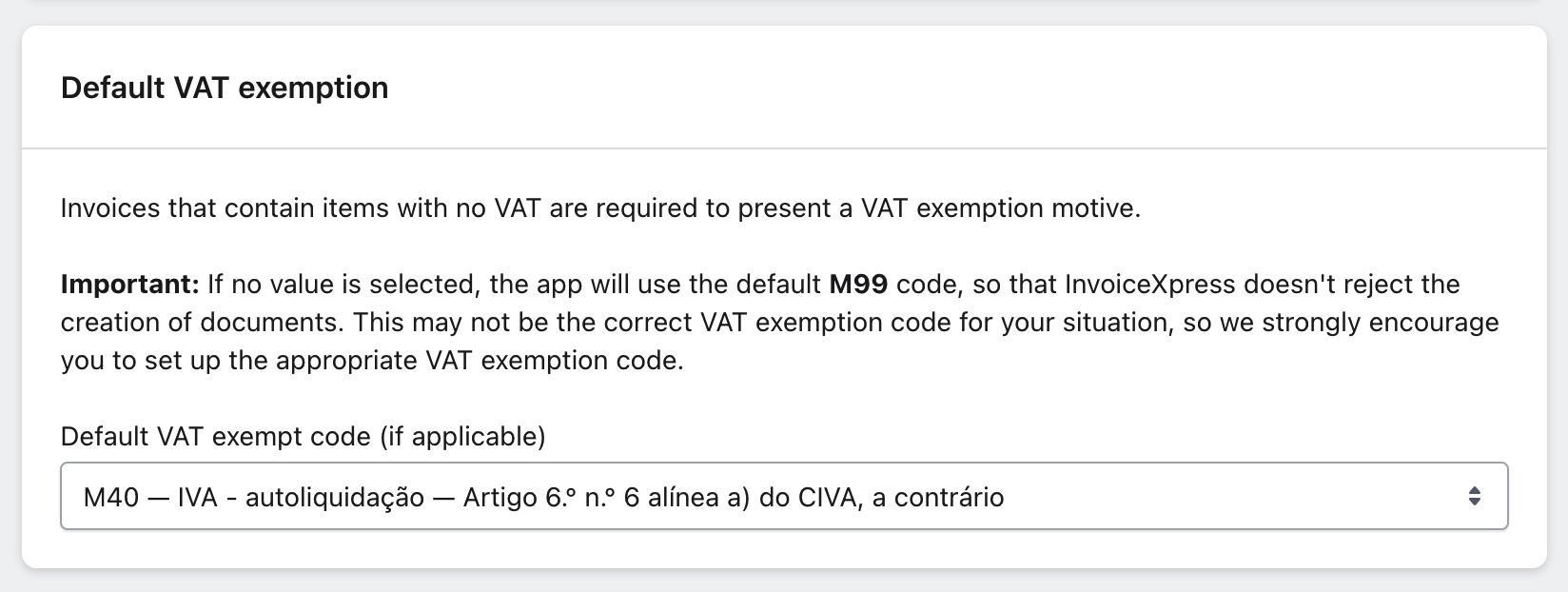

The Standard VAT Exemption feature ensures that all invoices containing VAT-exempt items clearly identify the reason for the exemption.

Selecting the Exemption Reason

Selecting a reason for VAT exemption is mandatory when issuing invoices with VAT-exempt items (or VAT = 0%). The reason should reflect the specific reason for exemption under the applicable accounting context.

Use the dropdown to select the appropriate reason for VAT exemption. This reason will be automatically included in invoices issued for VAT-exempt items.

Importance of Proper Selection

- Default Code M99: If no reason is selected, the app will default to code M99 to avoid rejections in InvoiceXpress.

- Recommendation: Set the appropriate exemption reason for your situation, as M99 may not be suitable for all cases.

EU Company VAT Exemption

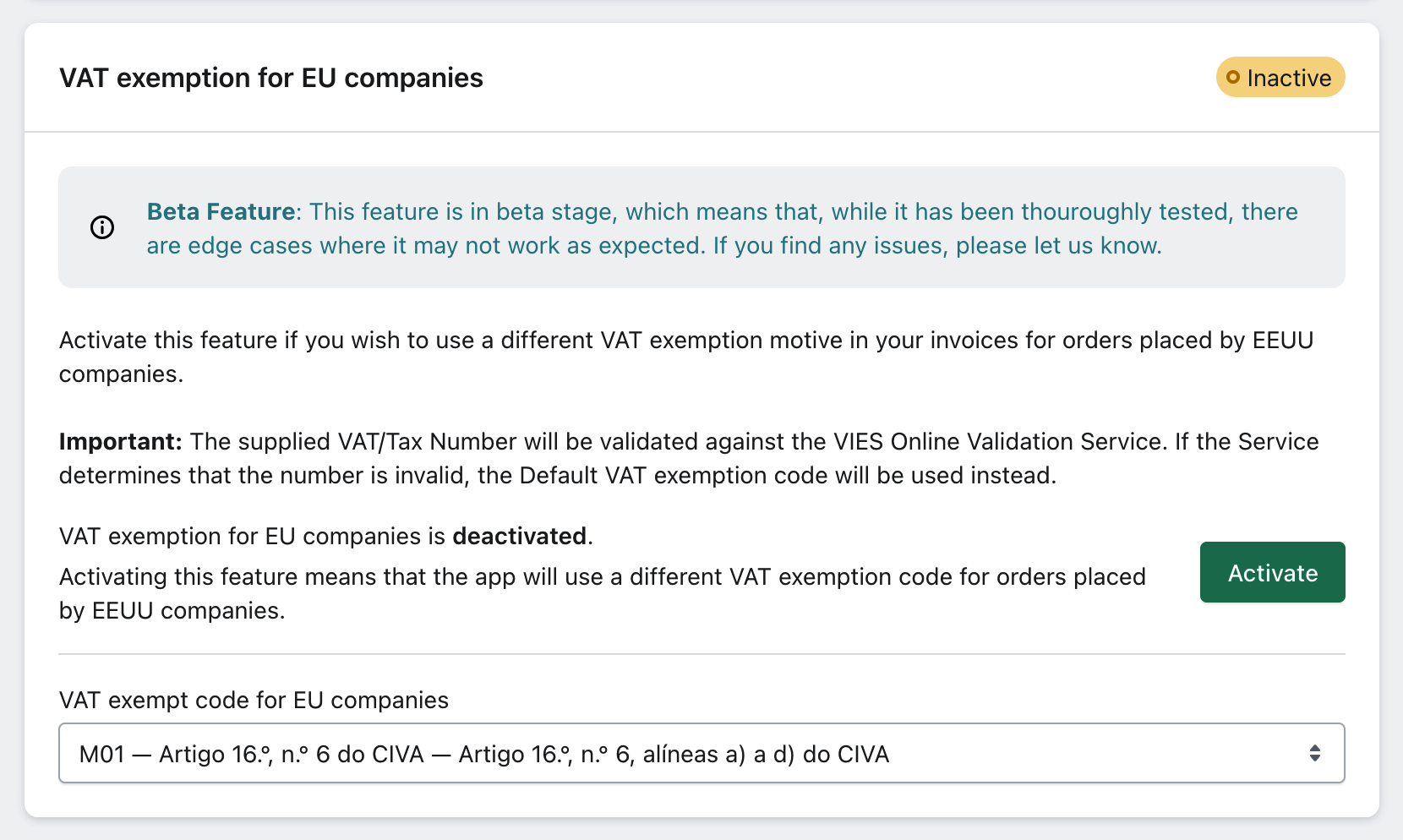

The EU Company VAT Exemption feature allows the use of specific VAT exemption reasons for invoices issued to companies registered in the European Union.

Enabling the Feature

- Enable this feature: Invoices issued to EU companies will include an alternative exemption reason suited to intra-EU transactions.

- The VAT/NIF provided will be validated through the VIES online service. If the VAT is deemed invalid, the app will default to the standard exemption reason.

- Disable this feature: The app will not apply specific exemption reasons for EU companies, using only the standard reasons set for all invoices.

Important Notes

- VAT Validation: Validating the VAT through VIES is crucial to ensure that only registered EU companies receive the specific exemption reason.

Conclusion

Correctly configuring the VAT Exemption options in xpressifi is essential to ensure that all issued invoices comply with Portuguese tax and customs regulations. Follow the instructions above to set VAT exemption reasons based on your store's needs and applicable regulations. If you have any questions or need further assistance, check other sections of our Knowledge Base or contact our support team.